Insurance Partner Program Announcement

LOUIS THAI International Group hereby announces the launch of its 2026 Insurance Partner Program, accompanied by a limited promotional e-Credit incentive applicable to eligible clients.

This announcement is made in the interest of transparency and public disclosure.

This page contains advertisements and promotional content.

About the Insurance Partner Program

The LOUIS THAI Insurance Partner Program is designed to collaborate with approved insurance partners in facilitating structured insurance advisory and policy renewal processes for clients.

Under this program, eligible clients who successfully renew an existing insurance policy or purchase a qualifying insurance plan through a recognised LOUIS THAI Insurance Partner platform may be entitled to receive a promotional e-Credit incentive, subject to applicable terms and conditions.

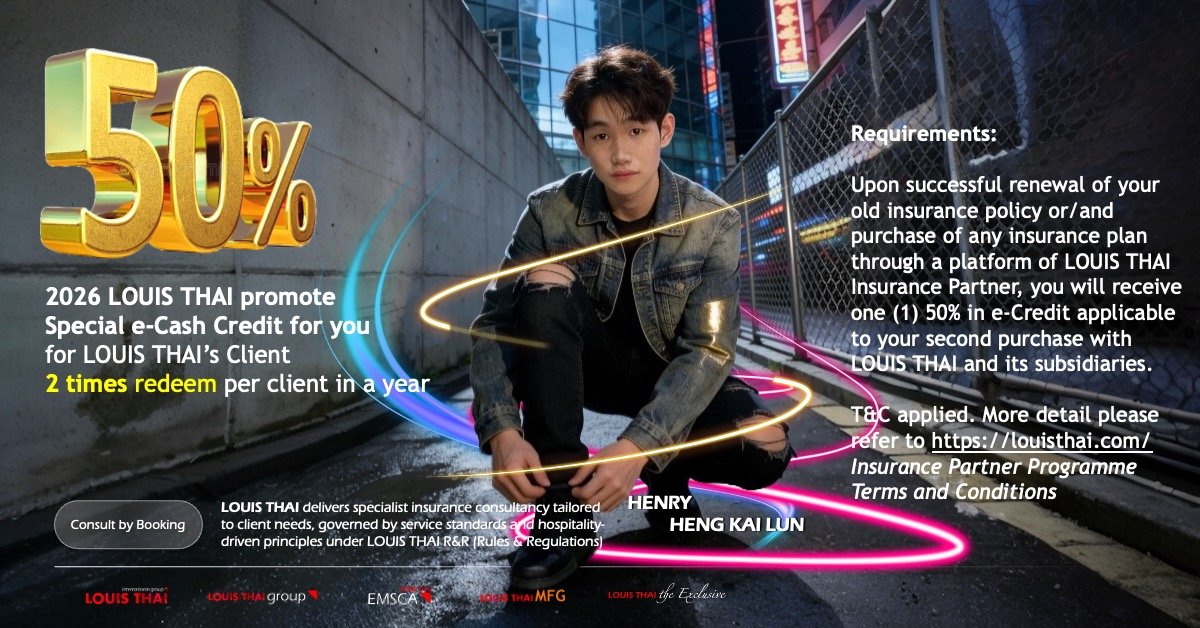

2026 e-Credit Promotion Overview

The current promotional arrangement includes:

- A promotional e-Credit incentive of up to 50%

- Applicable to a subsequent purchase with LOUIS THAI or its subsidiaries

- Limited to two (2) redemptions per client per calendar year

- Subject to eligibility, verification, and internal approval

This promotion does not constitute a rebate, cash payout, or guaranteed financial return.

Eligibility & Conditions

Eligibility for the promotional e-Credit incentive is subject to:

- Successful renewal of an existing insurance policy or

- Purchase of a qualifying insurance plan through a LOUIS THAI Insurance Partner

- Compliance with internal rules, verification procedures, and applicable regulations

LOUIS THAI reserves the right to amend, suspend, or withdraw the promotion without prior notice, in accordance with its Rules & Regulations (R&R).

Advisory & Consultation

All insurance-related consultations remain advisory in nature.

Clients are encouraged to review policy terms carefully and make informed decisions.

Consultation services are available by booking only, subject to availability.

Important Disclosure

This announcement is published for informational and promotional purposes only.

It does not constitute financial advice, investment advice, or an inducement to purchase any insurance product.

About LOUIS THAI

LOUIS THAI International Group delivers specialist insurance consultancy and financial advisory services through structured partner programs, governed by internal service standards, ethical principles, and hospitality-driven client service frameworks.

Memorandum of Memorandum of Discount and Rebate Mechanism

Insurance Partner Rebate — 50% e-Cash Credit (How It Works)

Eligibility

- Purchase i-Premium 2Y (RM350) to activate eligibility.

- Sign a policy with our Insurance Partner and complete verification.

Benefit

Once verified, you will receive a 50% Rebate e-Cash Credit that can be used to offset your purchases at LOUIS THAI.

Example (Invoice Breakdown)

Item: Witthi 9 Chan

Original Price: RM 1,800.00

Less: 50% Rebate e-Cash Credit: (RM 900.00)

Net Payable (Cash/Bank Payment): RM 900.00

Meaning: You receive RM900 e-Cash Credit, and you only need to pay the remaining RM900.

Redemption Limit

- Each customer may redeem the 50% e-Cash Credit promotion up to 2 times per calendar year.

Notes (recommended to include)

- e-Cash Credit is not exchangeable for cash and is non-transferable.

- e-Cash Credit may be used to offset up to 50% of the bill amount per redemption (unless stated otherwise).

- LOUIS THAI reserves the right to approve, verify, and reject any claim if requirements are not met.

3) Internal Accounting Journal Entries (Simplified & Most Common)

(1) Customer purchases i-Premium 2Y for RM350 (cash received)

02 Jan 2025 /* Cash Received Date */ Dr. Cash/Bank RM 350.00 /* Dr. */ Cr. Sales — i-Premium 2Y RM 350.00 /* Cr. */

(2) Customer qualifies; e-Cash RM900 is granted (recorded as a redeemable credit liability)

05 Jan 2025 /* Approval Date */ Dr. Marketing Expense — e-Cash Promotion RM 900.00 /* Dr. */ Cr. e-Cash Credit Liability (Customer Wallet) RM 900.00 /* Cr. */

(3) Customer purchases Witthi 9 Chan for RM1,800; uses RM900 e-Cash credit and pays RM900 cash

06 Jan 2025 /* Redeem Date */ Dr. Cash/Bank RM 900.00 /* Dr. */ Dr. e-Cash Credit Liability RM 900.00 /* Dr. */ Cr. Sales — Witthi 9 Chan RM 1,800.00 /* Cr. */

Insurance Partner Programme Terms and Conditions

2026 LOUIS THAI — Special e-Cash (e-Cash Credit Rebate)

INSURANCE PARTNER PROGRAMME TERMS AND CONDITIONS (“e-Cash Credit Rebate T&Cs”)

| Programme Name | 2026 LOUIS THAI Special e-Cash for you (Insurance Partner e-Cash Credit Rebate) |

| Issued By | LOUIS THAI International Group (Malaysia) Sdn Bhd (“Company” / “Us” / “We” / “Our”) |

| Insurance Partner Representative (optional display) | Henry Heng Kai Lun (Certified Agent Code: 6837341) |

PART I

1. Programme Period & Acceptance

- This 2026 LOUIS THAI Special e-Cash for you programme (the “Programme”) is valid from 01 January 2026 to 31 December 2026, both dates inclusive (“Programme Period”), unless otherwise stated in a written confirmation issued by the Company.

- By participating in this Programme, you agree to be bound by these e-Cash Rebate T&Cs.

1.1 Eligibility

This Programme is only open to customers (“Customer” / “You”) who:

a. are at least eighteen (18) years old on the date shown on your Identity Card / Driving Licence / relevant government-issued document;

b. are Malaysian citizens (unless the Company states otherwise in writing); and

c. during the Programme Period, have completed a Successful Insurance Transaction (defined below) through the platform / arrangement of LOUIS THAI Insurance Partner.

2. Personal Data & Consent

Prior to applying / claiming this Programme, you must:

2.1 consent to us collecting, using, and (where necessary) disclosing your personal information (including but not limited to name, birth date, NRIC/passport number, contact number, and insurance policy details) for the purpose of verifying eligibility, processing rewards, audit, and customer support;

2.2 ensure any personal data you provide to us is accurate, complete, and you have the right and consent to provide it;

2.3 inform and obtain your consent for our representative, manager, Customer Service Officer (CSO) or Person-In-Charge (PIC) to contact you via WhatsApp application / messenger application / phone call / email for follow-up; and

2.4 agree that the processing is made in compliance with the Personal Data Protection Act 2010 (PDPA).

3. Successful Insurance Transaction & Reward Entitlement

3.1 Successful Insurance Transaction

A promotion claim will be considered successful when all conditions below are fulfilled:

3.1.1 the renewal / purchase is made during the Programme Period; and

3.1.2 the insurance application is successfully issued / renewed and confirmed by the relevant insurer (including completion of underwriting, if applicable); and

3.1.3 the required premium / first payment has been successfully paid and not reversed / disputed; and

3.1.4 the policy is not cancelled during any free-look / cooling-off period (if applicable) or within thirty (30) daysfrom the policy issuance date (unless the Company decides otherwise in writing); and

3.1.5 it is made in compliance with these e-Cash Rebate T&Cs and applicable laws.

3.2 Important Insurance Disclaimer

- The Company / LOUIS THAI Insurance Partner provides marketing, referral, and/or facilitation services only.

- Final acceptance, underwriting decisions, and issuance of any insurance policy are solely determined by the insurer.

- The Company does not guarantee that any customer will be accepted by the insurer.

3.3 e-Credit Cash Rebate (Special e-Cash)

- Each eligible Customer who has made a Successful Insurance Transaction will receive one (1) e-Credit Cash Rebate (“e-Credit”) for that transaction, subject to the caps and rules below.

- The e-Credit is applicable to your second purchase with LOUIS THAI and its subsidiaries, subject to eligibility of products/services and any exclusions determined by the Company.

3.3.1 Rebate Percentage & Basis (Fixed at 50%)

a. The rebate percentage is fifty percent (50%) of the Eligible Premium Amount (as defined below) (“Rebate Percentage”).

b. “Eligible Premium Amount” means the premium amount actually paid and successfully posted/confirmed by the insurer for the Successful Insurance Transaction, excluding any taxes/fees/charges unless stated otherwise.

c. If any advertisement artwork, social media post, or verbal statement differs from the Company’s written confirmation, the Company’s written confirmation shall prevail.

3.3.2 Redemption Limit

The e-Credit reward may be granted and redeemed for a maximum of two (2) times per client in a calendar year.

3.3.3 Reward Issuance Timeline

The e-Credit will be issued on a date falling on or about thirty (30) working days after the Successful Insurance Transaction is confirmed, unless otherwise stated.

3.3.4 Validity Period

The e-Credit validity period is twelve (12) months from the date it is issued/credited, unless otherwise stated in writing. Expired e-Credit will be void.

4. Not Entitled / Disqualification

A Customer is not entitled to this Programme if the Customer:

4.1 is blacklisted from the LOUIS THAI customer list, banned partnership list, or has terminated the relationship with the Company before / during the Programme Period; or

4.2 has acted fraudulently or dishonestly, conducted in bad faith, or otherwise in an inappropriate manner to gain unfair advantage; or

4.3 upon the occurrence of any event giving rise to a right for the Company to suspend or terminate any (or all) agreement for service, as set out in the Company’s standard customer terms.

5. Nature of e-Credit

- The e-Credit is non-transferable, non-replaceable, and non-exchangeable for cash.

- The e-Credit cannot be credited to any bank account or third-party account, and cannot be converted into “cash rebate” outside the Company’s system.

- Unless expressly permitted by the Company in writing, e-Credit cannot be combined with other promotions/discounts.

6. No Automatic Right / No Guarantee

- The Company may request additional documents for verification (e.g., payment proof, policy schedule, receipt).

- If verification fails or information is inaccurate/incomplete, the Company may withhold, cancel, or reverse the e-Credit.

7. Redemption Rules

7.1 Redemption must be made by booking/arrangement with the PIC and subject to availability of eligible products/services.

7.2 e-Credit must be redeemed within its validity period; once redeemed, it becomes invalid.

7.3 The Company may impose product/service exclusions, minimum booking requirements, or operational rules from time to time.

8. Cancellation, Refund, Chargeback & Clawback

- If the Successful Insurance Transaction is later cancelled, reversed, refunded, disputed, charged back, or found to be ineligible, the Company reserves the right to cancel and/or claw back the e-Credit (including offsetting against future entitlements).

- If the e-Credit has been redeemed prior to clawback, the Company may require repayment or deduct equivalent value from subsequent benefits.

9. Liability

To the extent permitted by law, the Company shall not be liable for any losses, damages, costs, or expenses arising from improper/unauthorised use of e-Credit, wrongful redemption, or misunderstanding in relation to eligibility, except where caused by the Company’s fraud, wilful default, or gross negligence.

10. No Correspondence

The Company’s determination of all matters relating to this Programme shall be final and conclusive and no correspondence will be entertained.

11. Company’s Rights

The Company reserves the right to do any of the following at any time without prior notice:

11.1 make any changes to the Programme and/or replace the rebate percentage with another reward of equivalent or similar value; or

11.2 vary, modify, add, delete or otherwise revise any of these e-Cash Rebate T&Cs, including terminating or withdrawing the Programme, or extend/shorten the Programme Period at the Company’s sole discretion, with or without prior notice.

12. Inconsistency

In the event of any inconsistency between these e-Cash Rebate T&Cs and any brochures, marketing, or promotional materials relating to the Programme, these e-Cash Rebate T&Cs shall prevail to the extent of such inconsistency.

13. Standard Terms

These e-Cash Rebate T&Cs are to be read together with the Company’s standard Customer Terms and Conditions and any policy applicable to the relevant product/service (collectively, “Standard Terms”). If there is any inconsistency, these e-Cash Rebate T&Cs shall prevail to the extent of such inconsistency.

14. Third Party Rights

A guest, person, partnership, or any entity who is not a party to these e-Cash Rebate T&Cs has no right under the Contracts (Rights of Third Parties) Act 1999 to enforce any of these terms.

15. Governing Law

These e-Cash Rebate T&Cs are governed by and shall be construed in accordance with the laws of Malaysia.

16. Accuracy Statement

All information is correct at the time of writing. Latest Alter Date: 01 January 2026.

PART II

1. Project Overview

The scope of work entails the insurance advisory and facilitation arrangement on behalf to ensure the process is completed ethically and professionally. This Programme is related to customer’s insurance policy review, renewal and/or purchase arrangement through LOUIS THAI Insurance Partner, and the reward entitlement of Special e-Cash (e-Credit Cash Rebate) as stated in Part I.

2. Key Deliverables

2.1. Initial review of the customer’s needs and existing coverage (if any), to identify key potential issues and gaps in the first stage of service (insurance consultation).

2.2. Provide basic comparison / explanation of suitable plan(s) and/or renewal option(s) based on information given by customer, and highlight each issue from customer to person-in-charge of insurance submission (agent / partner).

2.3. Follow up consultation to discuss the progress of application / renewal and address any questions or concerns you may have (subject to insurer processing timeline).

3. Scop of Review

3.1. Identification of parties involved (customer, insurer, agent/partner) and their objective.

3.2. Examination of the customer’s aim (renew / purchase / improve coverage / cost optimisation).

3.3. Review of key factor affecting customer’s insurance decision such as budget, protection needs, exclusions, underwriting requirement (if any), and policy effective date.

3.4. Analysis and resolution proposal based on the previous consult (if any).

3.5. Evaluation of the type of plan applied potential and expected outcome (subject to insurer final approval).

3.6. Recommendations for enhancing the process efficiency, documentation readiness and your personal safety (avoid scams / only deal via official channels).

4. Processes and Timeline

4.1. The insurance consultation / arrangement will be conducted as customer request within the Programme Period stated in Part I, unless otherwise agreed in writing.

4.2. Following is the work phase’s schedule;

4.2.1. Phase 1 — Consultation & data collection (basic needs, existing policy, budget).

4.2.2. Phase 2 — Plan proposal / renewal option & confirmation.

4.2.3. Phase 3 — Submission to insurer & follow-up (underwriting/issuance/renewal confirmation).

4.3. Work done timeline depends on insurer’s processing; LOUIS THAI / Insurance Partner will follow up within reasonable time.

4.4. Ultimately the work done, in certain case of deferment by insurer or missing document, submission will be updated to you in next working hours.

5. Offering Price and The Products and The Services

5.1. Insurance premium is payable to the insurer and subject to insurer’s official confirmation.

5.2. Unless stated otherwise in writing, no additional “programme fee” is charged by the Company for the e-Cash reward programme itself.

5.3. Any separate LOUIS THAI products/services purchased (for redemption of e-Credit as “second purchase”) are subject to the Company’s official invoice and applicable product/service terms.

5.4. The Special e-Cash (e-Credit) reward amount is calculated and capped under Part I, with Rebate Percentage fixed at 50%.

6. The Terms & Condition

6.1. The above service arrangement is per customer basis and subject to verification/eligibility requirements under Part I.

6.2. The Company reserves the right to modify programme mechanics, redemption exclusions, timeline, or introduce new requirements with notice, for any reason, at its sole direction (subject to Part I “Company’s Rights”).

6.3. Customer must provide accurate and complete information; the Company shall not be responsible for delays in reward fulfilment due to inaccurate/incomplete/unavailable information provided by customer.

7. The Call to Action

If you have any further details to meet your requirement, or clarification, you should inform us immediately through our official contact / Person In-charge (PIC). Once again, thank you for choosing LOUIS THAI Insurance Partner Programme.

and then

and then